Dealflow.es #488: Qida raised €37M. TravelPerk to Perk & interview with Avi Meir (CEO). VC $$ for Spain.

A weekly summary of everything that happened in the Spanish startup and tech investing ecosystem.

👀 Sponsorship slots for 2026 are now open. If you’d like to get your brand in front of the founders, funds, and operators within the Spanish tech ecosystem, drop me a line at jaime@dealflow.es 👀

This week’s newsletter is sponsored by zenital:

How to turn fragmented portfolio data into a strategic operational database, in just weeks?

Unlocking the value of data across multiple acquisitions is a major challenge. One of our clients faced this head-on, aiming to consolidate data from over 20 portfolio companies into one single source of truth.

The zenital team stepped in to make it happen. Using Databricks and deploying on AWS, we cleaned and unified data coming from diverse sources. In less than two months, we delivered a fully operational database.

Want to see this happening for your business as well? Get in touch!

Last week, TravelPerk announced that it’s not only rebranding as Perk, but also expanding significantly its product. The new platform integrates travel, expenses, invoices, and corporate card payments into a single solution. The company also announced that it’s hit $300M in annualized revenue and that it will move its HQs to Boston and London.

To have more info on the changes, I had the chance of chatting to CEO Avi Meir last week. Here’s a condensed version of our exchange.

$PERK is a nice domain name and also a nice stock ticker, which is available. Any comments on that? :)

Yes, Perk is a name that opens doors. Right now our focus is on building long-term value for our customers and investors. The future will take care of itself when the company is ready.

Why drop “Travel” now? What’s the hardest part and risks of changing a brand and name when the previous one (TravelPerk) is well known?

Perk is a natural evolution. Travel was where we started, but today we’re helping companies manage all their travel, spend and payments in one intelligent platform. Change always comes with some risk, but if you prepare well and have great people, you can handle it. Our teams have done an incredible job with the migration and launch, and honestly, I believe the Perk name will outgrow TravelPerk faster than anyone expects.

Is Perk a bundled “travel + spend OS” that replaces best-of-breed tools, or a layer that coexists via integrations? Where do you integrate vs. replace first?

With Perk we offer one intelligent platform that brings everything together, while still giving customers real choice. If a company loves a tool, we’ll offer our marketplace so they can integrate with it. What we’ve seen in the data is that the fewer systems people have to juggle, the happier and more productive they are.

You’ve now acquired several businesses. From the outside it seems like some of those acquisitions were for market expansion reasons, while others were for product expansion. What have you learned about not just acquiring, but integrating these businesses and teams into Travelperk? Do’s and don’ts for other founders

What I’ve learned from the three acquisitions we’ve made is that success comes down to people and culture. You can integrate systems and products pretty fast, but alignment on core values and purpose is what really makes it work. All our acquisitions have shared the same obsession with customers and the same ambition to grow with purpose. The common thread is that we had the same approach to how we like to treat each other at work - being a good person goes a long way. That’s why the integrations felt natural from day one. In the end, it’s the people behind those companies that make them such a strong part of Perk.

Many in the Spanish press have noted that you’ve moved your headquarters (not the people) from Barcelona to the UK + US. Any comments on that? I think poeple need understand that this is normal and not bad at all

Perk is a global company serving over 10,000 customers all around the world. Establishing our hubs in Boston and London as dual headquarters brings us closer to our fastest-growing markets. North America and the UK now make up the majority of our business, so this is a natural next step in our journey.

We’ve learned to grow fast in complex markets, and that experience gives us the confidence to scale globally with the same focus and ambition that got us here. Barcelona remains a huge part of our story - it’s where we started, and it will always be home to much of our talent, innovation, and culture.

The press should realize that this is the natural and good evolution of a company that has global ambitions.

You guys have been vocal about using AI to increase margins and improve internal productivity. Since today’s update is also about productivity, are you expanding the use of AI to other areas within the company? Any relevant use cases or workflows, beyond the ones you’ve talked about in the past, that you mind sharing?

We’ve been making Perk AI-powered from the inside out, because when you give your own teams smarter tools, you build better products faster. Now we’re bringing that same energy to our customers. One area I’m really excited about is using AI to power team events, especially when it comes to bringing people together across locations. We’ve already tested it for our own global summer event, and it was a total game changer. That’s definitely one to watch.

Perk has -or is about- to turn 10. As CEO, what’s been the proudest moment to date? What will Perk look like in 10 years?

There have been many proud moments, but what stands out most is seeing how far we’ve come without losing sight of who we are. We started as a small team trying to make business travel better, and now we’re helping thousands of companies make work better. Ten years from now, I see Perk as the intelligent backbone of how companies operate - a platform that quietly removes the noise we call shadow work, so people can focus on what really matters. Achieving that means shaping the future of work, and I’m as obsessed as ever with solving the problems that actually make work better.

Startup funding news 💸

Barcelona-based elderly care startup Qida closed a €37M Series B round led by Quadrille Capital. Qida will use the funds to scale its tech platform, make acquisitions, and triple its workforce to 6,000 by 2027

Overture Life obtained a €20 M loan from the European Investment Bank to scale its automated and AI‑driven platform for in‑vitro fertilisation (IVF) and fertility preservation

Barcelona-based Kabilio raised €4M in a pre-seed round led by Visionaries Club and Picus Capital. Kabilio uses gen AI to automate accounting workflows and improve collaboration between advisory firms and clients. More from founder Jose Ojeda here

Devengo raised €2M from Bankinter, Banco Sabadell, Demium, among others. Devengo, founded in 2019, offers programmable A2A instant payment infrastructure and will use the funds to expand across the SEPA zone and into new markets such as Mexico, Brazil, the US, and the UK

Inveready invested €2 M into the Canary Islands‑based e‑commerce platform Syniva. The company supports consumers in the archipelago to purchase from any global online store

The Spanish tech transformation fund SETT invested €1M in Qilimanjaro, a Barcelona-based quantum computing startup

M&A news 🚀

Cirsa is negotiating to acquire a ~40 % stake in BitBase, the crypto exchange and ATM operator, which runs the largest network of Bitcoin‑ATMs in Spain and operates across Latin America. The full company is being valued at around €7 M, with BitBase processing roughly €50 M annual transaction volume

Wallapop’s disputed sale to Naver for just over €600M—below its last €800M valuation—remains unresolved, as dissenting investors like 14W pursue legal and alternative dispute resolution routes. A final agreement is still pending regulatory approval, and failure to resolve internal tensions could result in years of litigation

Visual Trans acquired DeiWorld, integrating its ERP solutions into its logistics and customs software ecosystem. The move expands Visual Trans’s reach to 500 clients across 25 countries

Ecotechers wrote about the story and exit of Reply.ai. The AI-powered customer support chatbot founded by Omar and Pablo Pera, was acquired by Kustomer in 2020 and later became part of Meta. Created pre-ChatGPT, the startup pivoted several times—moving from hospitality to insurance to e-commerce—before reaching €1.5M ARR. Though the deal was under €20M, it marked a notable early AI exit from Spainç

Wallapop’s disputed sale to Naver for just over €600M—below its last €800M valuation—remains unresolved, as dissenting investors like 14W pursue legal and alternative dispute resolution routes. A final agreement is still pending regulatory approval, and failure to resolve internal tensions could result in years of litigation

The co-founding tech partner of Todotaladros, Alberto Torron, is currently evaluating offers for his 15% stake as part of a broader investment reorganization and family succession process. The e-commerce company, founded in 2009, generated nearly €19 million in revenue in 2024

Investor & accelerator news 🚀

Armilar Venture Partners closed its Fund IV with €120M to back B2B startups in Spain, Portugal and Europe. Spanish public investor SETT, via NextTech, is among its LPs

Dutch VC firm Lumo Labs announced it will invest €25M in Spain through its new €100M impact and deep tech fund. It has already backed Sycai Medical, a medtech startup with AI for early cancer detection

LifeX Ventures, the US-based fund co-founded by Spanish entrepreneur Iñaki Berenguer, is preparing a second €100M vehicle focused solely on AI in healthcare

Public money interviews: Interview with José Marino García, Executive Director at SETT, and another one with Carolina Rodríguez, CEO of Enisa

Spanish investors active abroad:

Columbus Venture Partners joined a a $12.7M seed round in Accipiter Biosciences, a Seattle-based biotech

Cardumen led a $10M seed round in cybersecurity startup Malanta

Batir a largo plazo al mercado es complicado, y poca gente lo consigue. Si además no tienes tiempo o conocimientos para invertir en bolsa, lo mejor que puedes hacer es utilizar Indexa Capital.

Startup news 💡

New startups and product launches

New products:

Freepik launched Spaces, “an infinite canvas where teams create, collaborate, and automate workflows in real time”. Freepik celebrated its Upscale Conf last week in Malaga. CEO Joaquin Cuenca was interviewed in Diario Sur. Cuenca envisions Freepik as “the Adobe of AI” and emphasizes the firm’s edge in speed and strategic direction. The company’s user base is split between Europe and the US, with plans to expand into Asia

Galician startup Sense Aeronautics introduced SenseWeb, a web client built on top of its original REST-based SenseAPI, to meet growing demand from end-users seeking real-time video analytics without integration work

Zynap, a Barcelona-based cybersecurity company, developed an internal agentic development framework to accelerate product creation using AI. Spearheaded by COO Jordi Miró, the initiative integrates LLMs like Claude Code for tasks such as ticket creation, coding, testing, and documentation

Startup financials

TravelPerk rebranded to Perk and unveiled an AI-powered platform integrating travel, expenses, invoices, and corporate card payments into a single solution. The move reflects its broader mission to eliminate “hidden work” — repetitive tasks draining productivity across companies. With dual headquarters in Boston and London, Perk surpassed $300M in annualized revenue

Other news

Navantia and Multiverse Computing formed a strategic alliance to boost defense innovation in Australia. The partnership combines Navantia’s naval defense expertise with Multiverse’s advanced AI model compression technologies

Bihar Batteries, a Donostia-based startup developing sodium-ion batteries, plans to start commercialization in 2026. The company created its first battery prototype and, in collaboration with CIC energiGUNE, developed promising sodium-ion cell prototypes

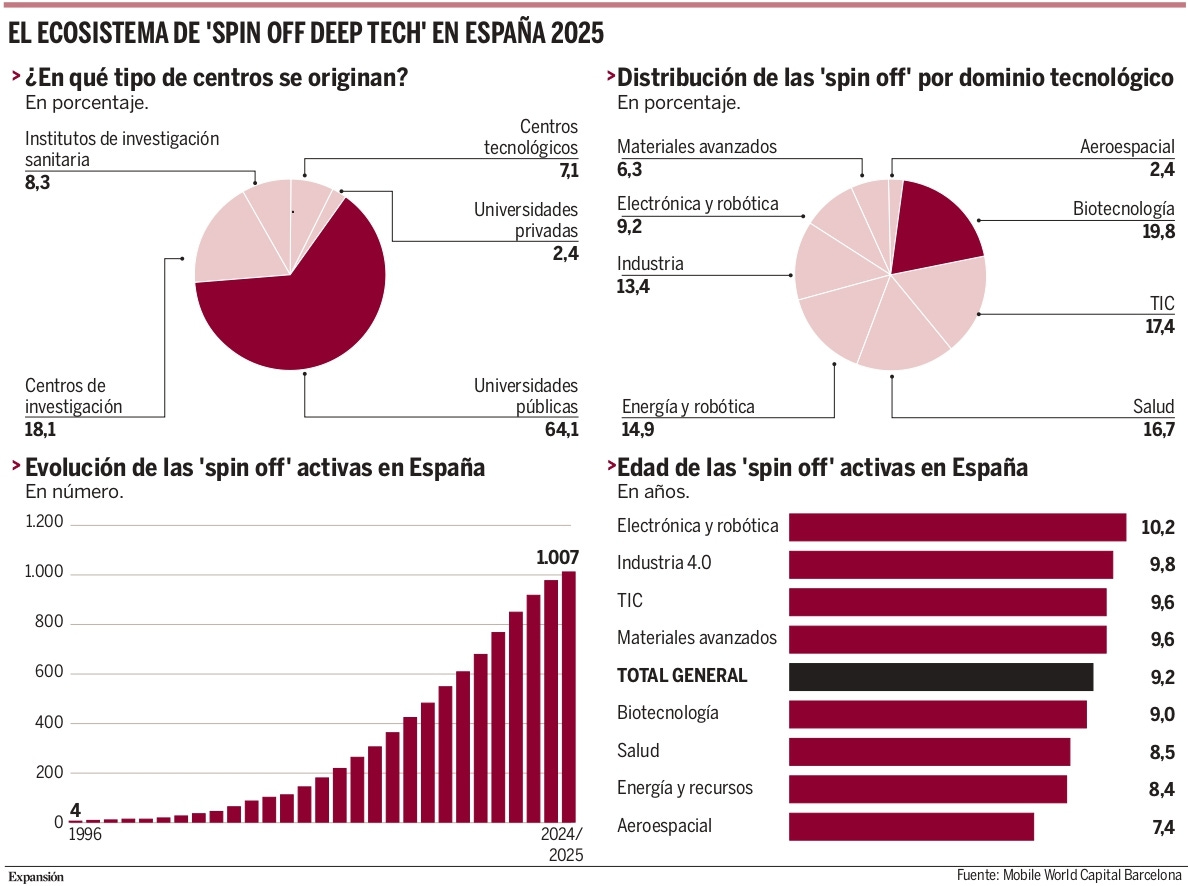

A report by MWCapital states that over two-thirds of Spain’s deep tech spin-offs were launched from universities, with 64.1% coming from public institutions. Catalonia and Madrid lead in spin-off density, with strengths in biotech, ICT, and health. More about the report here

Big company & policy news 🤓

Telefónica unveiled its Transform & Grow plan through 2030, aiming for €3B in annual savings via AI, operational simplification, and asset sales. To protect its investment-grade rating, the company cut its 2026 dividend in half to €0.15/share, triggering a 13% stock drop. It also plans to free up €8B for acquisitions without raising debt or capital. Telefónica will continue its disinvestments in Latin America, including Venezuela. The plan targets 2.5–3.5% annual revenue growth by 2030

Amadeus posted a €1.09B profit through September, up 10.1% YoY, with revenues rising 6.4% to €4.9B and free cash flow hitting €955M. Amadeus also invested over €1B in R&D this year, focusing on AI and digital transformation in travel

Belgium-based IMEC, a leading semiconductor R&D institute, will open its first international centre in Málaga with a €615M investment. The site is expected to create 200 direct jobs and support broader chip innovation in Spain

Interesting reads 🤓

Pablo Santos Luaces (PlasticSCM, sold to Unity) wrote “Merges desmitificados”

Ignacio Arriaga wrote “Por qué deberíamos evitar el virus corporativo”

David Bonilla wrote “La Administración, en llamas”

Pau Ramon (former CTO of Factorial, now building Ramensoft) published “The Talent Machine: A predictable recruiting playbook for technical roles.”

Ray Garcia (former Engineering Director at Factorial) published “Farewell, Factorial” and wrote an inside view about what working at the company feels like

Aily Labs Iberia got closed $80M round last week :eyes: