Dealflow.es #494: Barkibu completes €40M deal. Onum M&A details. Secondary founder transactions.

A weekly summary of everything that happened in the Spanish startup and tech investing ecosystem.

Welcome to another edition of Dealflow. If you’ve been forwarded this email but you’re not a subscriber, please do so here.

👀 Sponsorship slots for 2026 are now open. Demand has been stronger than I expected and I only have 13 slots/weeks remaining for all of 2026. If you’re interested in sponsorship opportunities, send me an email at jaime@dealflow.es 👀

This week’s newsletter is sponsored by Holo:

Estas Navidades, sáltate los regalos que acaban olvidados en un cajón. El mejor regalo es salud.

Holo es el servicio de salud más avanzado para quienes quieren comprender su cuerpo y llevar su salud al siguiente nivel. Un regalo que no se queda en el momento, sino que acompaña todo el año.

Con Holo, regalas:

2 analíticas al año, con más de 110 marcadores en total

(las analíticas tradicionales suelen cubrir solo 15–20)Una app todo en uno: sube informes pasados, guarda tu contexto y protocolos de salud, e integra tus wearables (Apple Watch, Oura, Garmin…)

Holo AI, que traduce datos complejos del día a día en señales claras.

Un informe de salud personalizado tras cada analítica, realizado por médicos expertos en prevención y longevidad

Porque los buenos regalos muestran que te preocupas por alguien más de lo que imagina.

🎁 Esta Navidad, regala salud. Descubre Holo y regálalo en tryholo.com

Startup funding news 💸

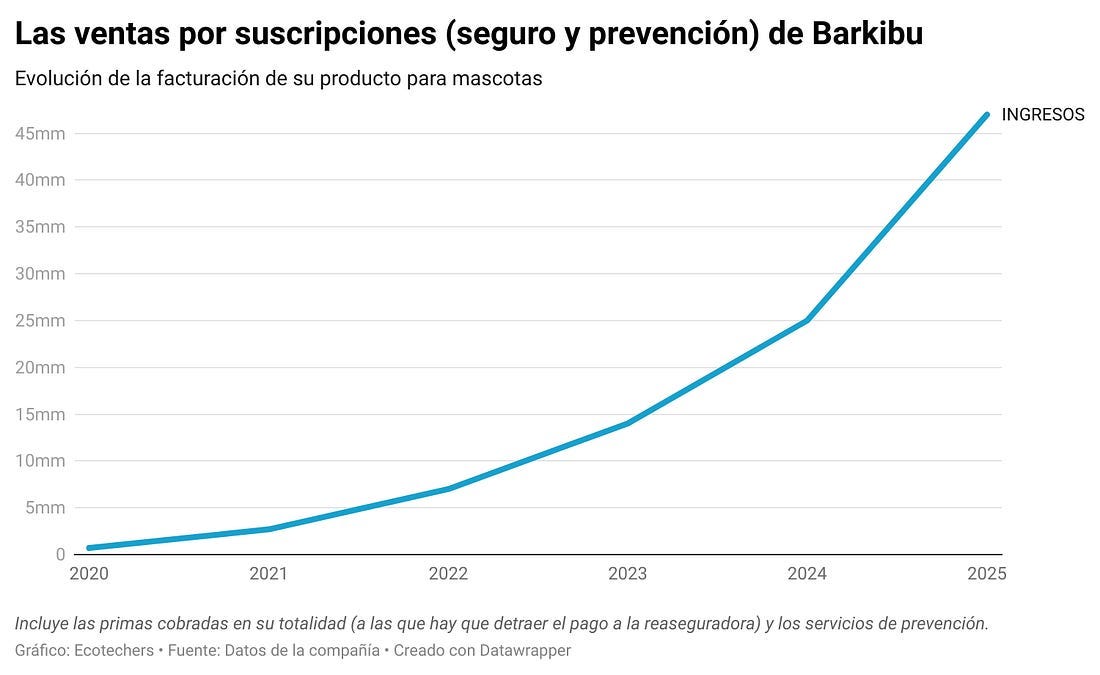

Galician pet health startup Barkibu announced that this year it completed a €40M primary + secondary transaction with Correlation Ventures. The company also announced that it will close the year with €47M in annual paid subscriptions. Barkibu has been around for more than a decade and went through several pivots until they found strong product-market fit with the current insurance product. We at Kfund first invested in the company in 2021 and we didn’t sell any shares in the Correlation transaction. We believe the best is yet to come

Playtomic raised €5.1M from more than 4,600 private investors via Crowdcube, opening its cap table to players, clubs and fans of its racket-sports booking platform

InfiniteWatch has raised a $4M pre-seed round led by Base10 Partners with participation from Kfund, Kibo Ventures and others, to launch its AI observability platform that helps companies monitor, measure and deploy AI agents across web and voice customer interactions. More info here. The company is led by several CoverWallet alumni, including former CEO and founder Iñaki Berenguer, as well as Pablo Molina (ex CTO) and Alberto Gonzalez (ex CTO, VP Eng)

Wodan AI has closed a €2M pre‑seed funding round led by JME Ventures, Swanlaab and Adara Ventures. Wodan AI develops homomorphic encryption technology that allows AI models to process fully encrypted data without compromising privacy

Eltex has closed a €1.8M funding round led by Vireo Ventures with support from Kopa Ventures to accelerate its integrated residential electrification platform

Flinket, a Madrid-based platform in open insurance and wealthtech, raised €1.4M. The round includes backing from Antai Venture Builder founders Gerard Olivé and Miquel Vicente, ex‑Cuatrecasas partner Eduardo Ramírez, and adds MGC Mutua as a strategic partner to strengthen regulatory support

M&A news 🚀

Onum’s sale to CrowdStrike has now been revealed to be far more complex than the headline figure, with the economics of the deal approaching $350M once cash, working-capital adjustments and incentive packages are factored in. Newly disclosed filings show over $40M in stock-based bonuses and retention packages for key executives and employees

Agile Content received a €51M takeover bid from a consortium led by Onchena (Ybarra Careaga family), Inveready and José Eulalio Poza. Agile Content is a video, TV and digital media technology provider, which guides €46–48M revenue and €11–12M EBITDA for 2025.

GrandVoyage debuted on BME Scaleup with a nearly 20% first-day jump, valuing the Catalan travel-tech company at around €20M. The experiential and tailor-made travel marketplace reported ~€21.5M in revenue in 2024 with positive EBITDA of around €1.3M, and reached €22.5M in revenue and ~€1.6M EBITDA through September 2025

Indra acquired Wake Engineering, the drone unit of Spanish group CPS, in a deal valuing the business at €8–12M, strengthening its push into unmanned aerial systems

Micole acquired the UK-based platform International School Advisor to build what it claims is the world’s largest global aggregator of educational centres

Investor & accelerator news 🚀

ICO announced a more flexible access to its VC programmes, allowing fund managers to request capital contributions at any time, rather than only during fixed windows

New funds:

Suma Capital is preparing the launch of SC Expansion Fund III, a new growth fund for Spanish SMEs targeting around €200M. The fund will invest in 8–10 companies with revenues of €10–60M, focusing on high-growth businesses linked to sustainability, health, social inclusion and digital transition, building on the strong performance of SC Expansion Fund I, which delivered a 7x gross return to investors

Creas Impacto II has reached a size of €56M following the entry of Cofides, and Aurae Impact, a French impact-focused family office. The fund will back impact-driven startups across education, healthcare and mobility, with a final close expected in February 2026 and a target of €100M AUM

Impulso Global – Fund of Funds reached its final close at €40M, led by Cardumen Capital and Portocolom AV. The fund of funds focuses on backing international VC managers specialised in impact, deeptech and sustainability, with a strong European bias and exposure to North America

Spanish investors active abroad:

Mundi led a $27M round in Israeli/US insurance company Parametrix

Batir a largo plazo al mercado es complicado, y poca gente lo consigue. Si además no tienes tiempo o conocimientos para invertir en bolsa, lo mejor que puedes hacer es utilizar Indexa Capital.

Startup news 💡

New startups and product launches

Cabify is preparing to launch robotaxis in Spain. The Spanish VTC group is closing partnerships with international autonomous vehicle players while working with regulators, with Madrid seen as a likely first testing ground and 2026 as the earliest window for commercial deployment

Ramensoft has been bootstrapped with €400k by former Factorial executives to build a human-first content platform designed to help companies create authentic, high-quality content in an AI-saturated environment. Its first product is Fika

Landbot launched Landbot 4, a product update designed to eliminate the trade-off between flexible AI agents and high-conversion, button-based chatbots

Factorial launched Factorial IT, a new product line aimed at automating and securing IT operations for SMBs, led by Biel S., who steps down as Chief of Staff to the CEO. The initiative targets €10M ARR in 12 months

Startup financials

Tech consulting and media firm Mio Group is targeting €100M in revenue by 2027–2028 after completing its delisting from BME Growth. In 2024, Mio reported €58.4M in revenue, €1M EBITDA and €3.6M net losses

Mundimoto reported a tough 2024, with losses widening 61% YoY to €8.1M and revenue falling 15% to €46M, as the motorcycle marketplace pivots its strategy toward renting. Mundimoto is now betting on renting to restore profitability and long-term sustainability

VIVLA expanded its financing capacity to €55M via a real-estate asset-backed credit facility led by Fasanara Capital

Other news

Profile of Maisa, the company that has developed a platform designed to audit and explain how AI models make decisions, helping companies in highly regulated sectors understand data sources, errors and reasoning behind LLM outputs

Uber Eats could face criminal action in Spain if it does not immediately hire its self-employed couriers, according to the Ministry of Labour

Revolut will open new hubs in Madrid and Barcelona and plans to hire 800 people in Spain by 2028, reinforcing its long-term commitment to the market

Big company & policy news 🤓

More details about Telefonica’s ERE. It will affect at least 4,539 employees in Spain

Amazon has agreed to cut 791 jobs at its Barcelona offices, down from an initial plan affecting 978 employees, following negotiations with unions. More details here

Kumo Networks has been rebranded as El Corte Inglés’ standalone data-centre subsidiary after the group took full control of the business, formerly operated with Kio Networks. The unit secured its largest-ever public contract, a €27M, five-year deal with the Region of Murcia

Interesting reads 🤓

Bernardo Quintero (Virustotal) published “Dos bytes, un autor y 33 años: la historia completa del Virus Málaga”

Pepe Borrell (Masia) published “Learnings From One Year Building a Super Angel Fund from Barcelona”

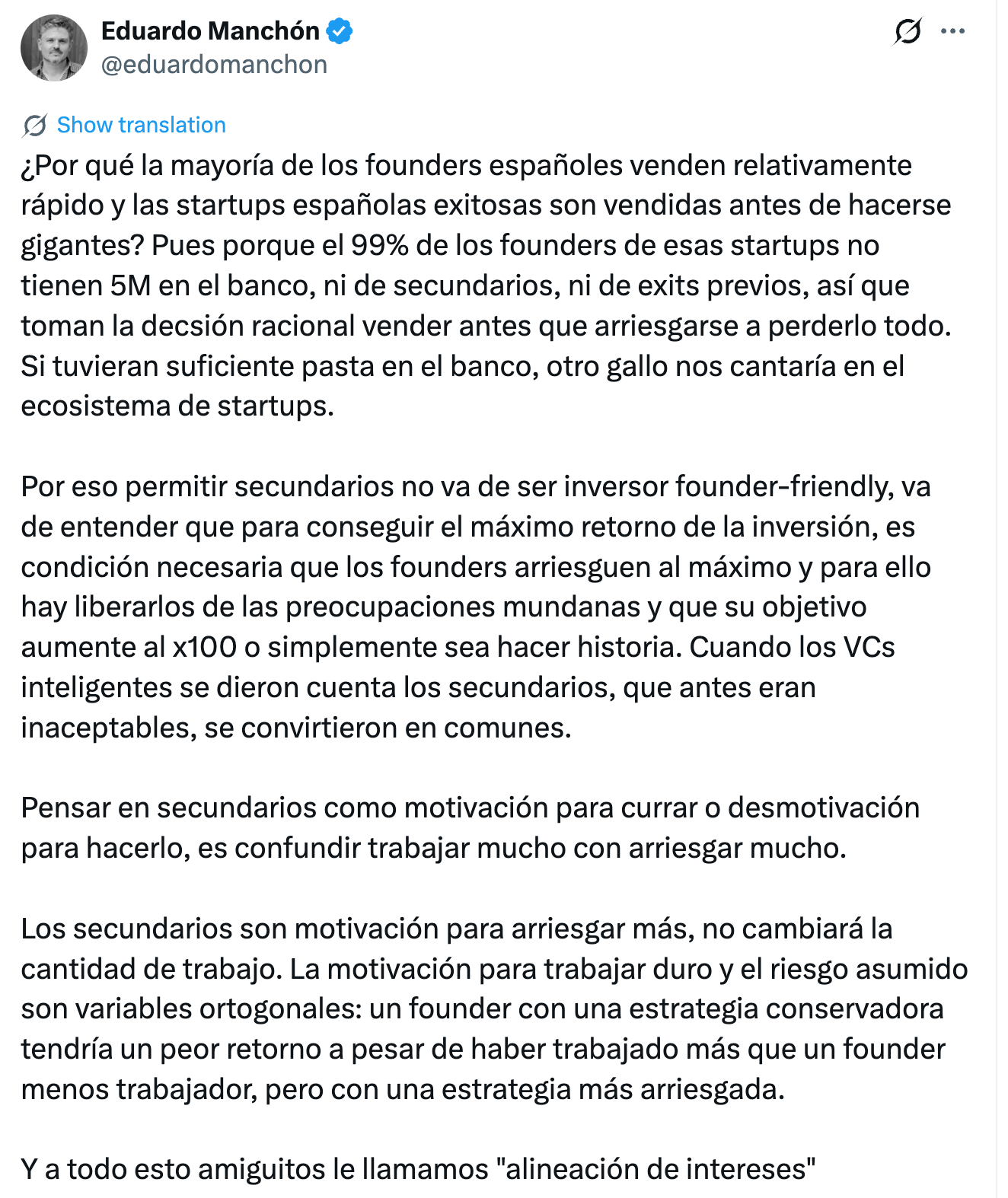

Interesting discussion on Twitter about the role that secondary transactions can play in the development of a tech ecosystem, and on whether they can be a net positive or negative for founder ambition. Click on the images for more details